The forthcoming Forum on China-Africa Cooperation (FOCAC) summit in Dakar, Senegal, confronts a relationship that is expanding but remains deeply asymmetrical. After 21 years of triennial summits, there is a widespread perception that China still benefits more from the relationship than its African partners.

Africa maintains a structural annual trade deficit with China amounting to over $20 billion. With large-scale manufacturing largely absent, African countries continue importing expensive finished goods from China while exporting cheaper raw materials. African countries depend on Chinese firms and lenders to finance and build critical export infrastructure. Yet African firms face significant entry barriers to China’s value-added product markets relative to commodity exports.

Another persistent problem is that too often African elites harness Chinese largesse to build patronage networks, strengthen their political positions, and maximize self-enrichment. The lack of transparency in these deals is often detrimental to African citizens’ interests. Critical regulations regarding debt ceilings, environmental and labor standards, public oversight, and knowledge transfer are flouted, leaving the respective African nation in a perpetually weaker position relative to China.

At the same time, pushback by African civil society is increasing and putting the relationship under more scrutiny as shown by the growth in recent media reporting, litigation, and protests targeting Chinese projects. Kenya’s loss-making Chinese-built Standard Gauge Railway (SGR) is a case in point. In June 2020, the Kenyan Court of Appeals declared the SGR contract illegal because it was not negotiated through a “fair, transparent, equitable, competitive and cost-effective” process—resulting in an unfavorable outcome for the public. While civil society engagement did not prevent Kenya from committing to the controversial deal, civil society organizations pushed for answers throughout the process, demanded more transparency, and launched multiple lawsuits.

FOCAC 2021 thus takes place in a context of growing questions over how Africa’s ruling elites manage their relationships with China. This is spurring growing calls to overhaul the partnership, including revisiting FOCAC’s institutional architecture.

Four Major Themes that have Shaped FOCAC in the Past Two Decades

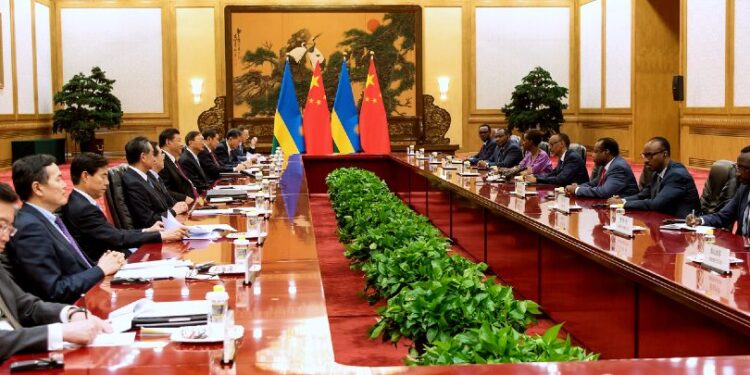

A process rather than a mere series of summits. More African leaders choose to attend FOCAC than the UN General Assembly, the world’s largest summit. In 2018, 51 African presidents attended the FOCAC summit compared to just 27 at the General Assembly 2 weeks later. A central appeal of FOCAC is its focus on cultivating close partnerships (huǒbàn, 伙伴). Its agenda is negotiated quietly through dialogues at the ambassadorial, director-general, senior official, and ministerial levels, alternating between African and Chinese venues. Strategic priorities are laid down in 12 policy forums like the China-Africa Defense and Security Forum and the Ministerial Forum on China-Africa Health Cooperation. Technical organs like the China-Africa Local Government Cooperation Forum and the China-Africa Think Tanks Forum organize short-term training. Specialized think tanks within the Chinese government organize programs to give African recipients deeper exposure to China. The China-Africa Press Center, for example, offers 10-month fellowships for African journalists under the auspices of China’s foreign ministry.

Focus on training and capacity-building in Africa. FOCAC’s in-country training model consists of:

- multiyear programs for public servants with managerial and policy responsibilities

- mentorship programs linking African and Chinese institutions

- political party exchanges to train cadres and diffuse norms

- vocational education workshops

Roughly 50,000 training slots are distributed to African Union (AU) members across these 4 categories triennially. An additional 60,000 go toward educating civilian and military students, including several thousand at the leadership level. By 2020, China was providing more training for Africans than any other country, having overtaken India, Germany, Japan, and the United States.

These training programs are driven by Chinese institutions, however, leading to calls for giving Africans a greater role in designing programs meant for their benefit. Countries like South Africa have created binational commissions dedicated to leveraging FOCAC and shaping its institutions.

China’s cultural presence has also grown. In 2000, China had no cultural institutes in Africa and educated less than 2,000 African students. Presently, China has the second largest number of cultural institutes in Africa after France’s Alliance Française, having overtaken the British Council, Germany’s Goethe Institute, and the State Department’s American Centers, which have operated in Africa since 1883, 1934, and 1960, respectively. The number of African students studying in China has ballooned to 60,000, making China the top destination for English-speaking students.

Expanding China’s reach. In 2009, China displaced the United States as Africa’s largest trade partner, with total trade topping $200 billion in 2020. Chinese imports from Africa constitute between 20 to 30 percent of this trade volume and are dominated by crude oil and hydrocarbons, minerals, precious stones, and base metals. African imports from China consist of machinery, transport equipment, electronics, textiles, and footwear. These skewed trade patterns have led to calls for China to immediately remove tariffs on African value-added products as a means to increase the quality of Africa-to-China trade.

Investment in infrastructure and telecommunications. In 2000, China’s investment stock in Africa was just 2 percent of U.S. levels, with fewer than 200 Chinese firms on the ground. This soared to over 55 percent of U.S. levels by 2020, and the number of Chinese firms expanded to over 10,000, of which about 10 percent are state-owned. In construction alone, China’s state-owned firms have generated over $40 billion in revenues annually since 2012 in Africa. They finance one in five and build one in three projects, making China the single largest player in African infrastructure. Transport and energy infrastructure dominate Chinese foreign direct investment (FDI), along with utilities, technology, and real estate. Sixty-five percent of Chinese lending goes to these same sectors, making it difficult to neatly separate loans from investments.